Our latest infographic – Financial Vulnerability in the UK - published as Consumer Duty goes live

- 31 July 2023

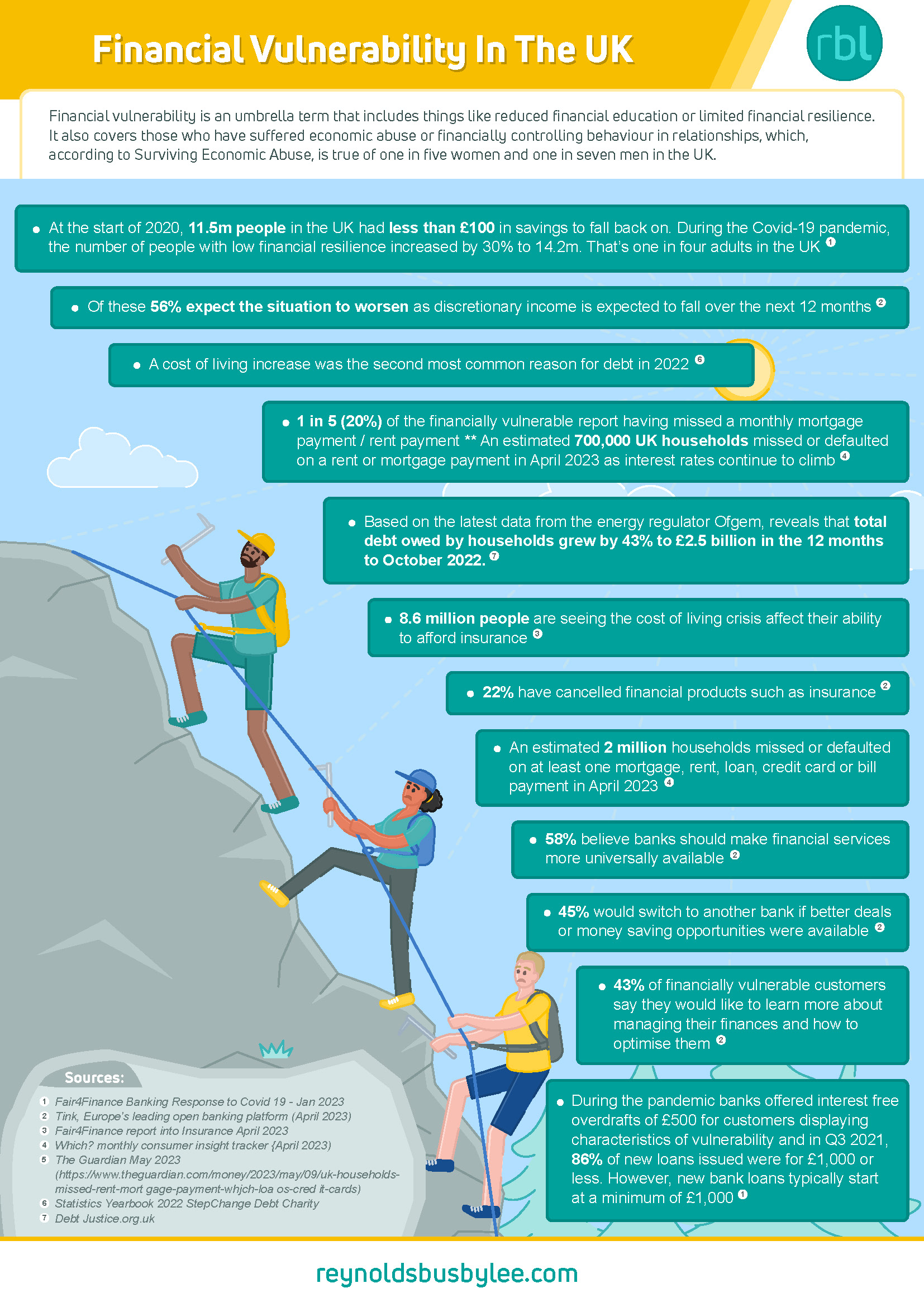

Consumer Duty from the Financial Conduct Authority is now in place, so it seems like the appropriate time to share our latest infographic about the uphill climb faced by many vulnerable customers experiencing financial vulnerability in the UK. The FCAs’ Financial Lives survey from May 2022 showed a significant increase in the number of UK adults experiencing low financial resilience – up to “1 in 4 (24%) of all UK adults who could quickly find themselves in difficulty if they suffer a financial shock”. The FCA advised that “this result is much worse that we recorded in our February 2020 Financial Lives survey”.

The main reasons for the increase in low financial resilience was the number of adults who claimed to be “heavily burdened by their domestic bills and credit commitments”. Having since gone through the winter fuel increases, the soaring interest rates pushing mortgage and rental payments up substantially and inflation topping 10% in recent months (although it does now appear to be coming down), it’s not hard to appreciate that these numbers are likely to have increased further.

The stats show that almost 1 in 4 UK adults are experiencing financial vulnerability in the UK and yet the solutions currently being offered by UK banks and financial services companies are not always what's needed by the customer.

In addition, as reported just last week on July 25th, the FCA has identified that over seven million people had unsuccessfully attempted to contact one or more financial services provider in the 12 months to May 2022. The regulator says that this shows how important Consumer Duty is going to be as “the most vulnerable in society are most likely to struggle with this”.

At times like this when consumers are feeling financially vulnerable, it's therefore important that firms work with customers to find out how best to support their individual needs and don't assume an in-market product or service designed in 'other' times will still be appropriate. It’s clear from the FCA’s report that customers are struggling to even reach their providers let alone to identify ways of accessing help and forbearance.

Covid and the Cost-of-Living crisis have changed the landscape substantially for both UK consumers and firms since 2019 and new requirements need to be identified and responded to. It’s clear that there are challenges for both firms and consumers to be able to meet the demands for service and interventions just now (see our blog A Crisis in Customer Service for more information on the challenges suppliers face).

With consumers not currently able to vote with their feet in some markets where energy and mortgage providers have withdrawn products from the market, we’ll be keeping a keen eye on how the FCA enforces compliance with the new requirements and how quickly it acts – all the indicators are that it means business and will act swiftly, but only time will tell.

If you'd like a copy of any of our infographics CONTACT US and we can send you an electronic copy to share with your teams.